first digital credit card limit

Everyone who gets approved for First Digital Card is guaranteed a credit limit of at least 300 and particularly creditworthy applicants could get limits a lot higher than that. Its important to note that with every credit limit increase comes a fee which is 25 of the amount of the increase.

/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)

Secured Vs Unsecured Credit Card What S The Difference

Inform the customer service representative that youve lost your credit card.

. Secure access to CVV the three numbers which can usually be found at the back of a card via the app. Perfect credit not required for approval. You start with a 300 credit limit.

The First Digital Mastercard is an unsecured card so you dont have to. Each time you want a virtual account number you visit the Citi website and request one. Ask the First Digital rep to cancel your old credit card and send a replacement.

If they reject you then the secured version or a capital one secured card. Provide any requested information such as your date of birth or the last four digits of your SSN. Call First Digital customer service at 1 844 358-0074.

Residential address and status. Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. 7500 for first year.

Can anyone recommend a credit card for first timers that has a high credit limit. Build up your Credit with a card that reports to all three major credit bureaus every month. Paperless and plastic-free apart from regulatory required communications - for example letters regarding changes to your credit limit.

You can choose the virtual card design freeze the card after payment set personalised limits change notification settings and keep track of the transactions made with the card in the Activity tab. Digital credit card is considered right for those people who have limited or bad credit so it is called digital credit card or digital Mastercard is an expensive unsecured credit card for people with limited or bad credit because when applying for it now So it charges 95 before account opening and then 75 annual fee in the first year when your first year is over and then. If youd like to join in please sign in or.

Typically you have to provide 300 500 and your credit limit will be equal to the amount you deposit. Perfect credit not required for approval. For cards rates and fees click here.

Citi Custom Cash gives you 5 on you biggest spend category on up to 500 a month. Cant use the card abroad. Secured cards are collateralized by your cash deposit that the issuer uses to ensure you meet your payment obligations.

400 credit limit doubles to 800. Simply make your first 6 monthly minimum payments on time All credit types welcome to apply. They tend to be the easiest to start off with.

We would like to show you a description here but the site wont allow us. Initial credit limit of 300. Simple application with a quick decision.

A secured cards credit limit equals with rare exception the amount you deposit. We may approve you when others wont. The First Digital Card credit limit is 300 or more.

You must enroll with Citi before you access this feature. Easy and secure online application - It takes just moments to apply. Dont do any credit building loans or credit one or any other BS.

The higher an applicants credit score and income are the higher the starting credit limit is likely to be. Approval does not require a perfect credit score. Tap on Pay to reveal the card number expiration date and CVV code.

Reports activity to the 3 major credit bureaus. See website for Details Rewards Snapshot of Card Features Get the security and convenience of a full-feature unsecured MasterCard Credit Card accepted at millions of merchant. After that 4800 annually.

Limit increases are available after the account has been open for 12 months with six consecutive months of on-time payments. Monthly reporting to the three major credit bureaus. No annual foreign exchange or late payment fees.

43 Overall Rating Perhaps the most important thing to understand about the First Access Visa Card is that it isnt meant to be your forever card. Full-feature Mastercard credit card accepted nationwide. Get the security and convenience of a full-feature unsecured Mastercard Credit Card accepted at millions of merchant and ATM locations nationwide and online.

Welcome to the Digital Spy forums. Im sure a little research will help you find the right card. We may approve you when others wont.

Some Citi cards offer virtual account numbers you can use for online and mail-order purchases with no monthly fee for the service. You can see if you qualify for an Apple card without impacting your credit. This means a 200 credit limit increase will cost you 50.

When you start out with credit its perfectly normal for your first credit card to have a small. You can get a First Digital Mastercard credit limit increase online or by calling 1-844-358-0074. Initial Credit Limit of 40000 Subject to available credit Fast and easy application process.

Build up your credit history with a card that reports to all three major credit bureaus every month. There is no credit check. 300 credit limit subject to available credit The First Access Visa Card is issued by The Bank of Missouri pursuant to a license from Visa USA.

7500 for first year. This is low considering the card costs 170 the first year in fees alone. Credit limit increase fee.

You can get a First Digital Mastercard credit limit increase online or by calling 1-844-358-0074. Or if you want a simple 2 card the sofi card gives unlimited 2 back on everything and cashback gets awarded within days of purchase rather than having to wait each month. You may also qualify for a Capital One or Discover card.

Starting credit limit of 250-1200. Currently the Secured Sable ONE Credit Card offers the highest maximum credit limit 10000 although there is no minimum required deposit. Citi Double Cash Card.

Can anyone recommend a credit card for first timers that has a high credit limit. In terms of fees and rates this card has more fees and higher rate relative to its peers. If you request a credit limit increase and your request is approved youll pay a 25 fee of the amount of the increase.

Tap on one of your cards in your Wallet tab.

First Premier Bank Mastercard Card Review Nextadvisor With Time

The Best Credit Cards For Building Credit Of 2022

First Access Credit Card Reviews 2022

First Digital Mastercard Reviews Is It Worth It 2022

The Best Credit Cards For Building Credit Of 2022

1 000 Credit Limit Credit Cards For Bad Credit 2022 Badcredit Org

Personal Credit Cards For Newcomers To Canada Rbc

The Best Credit Cards For Building Credit Of 2022

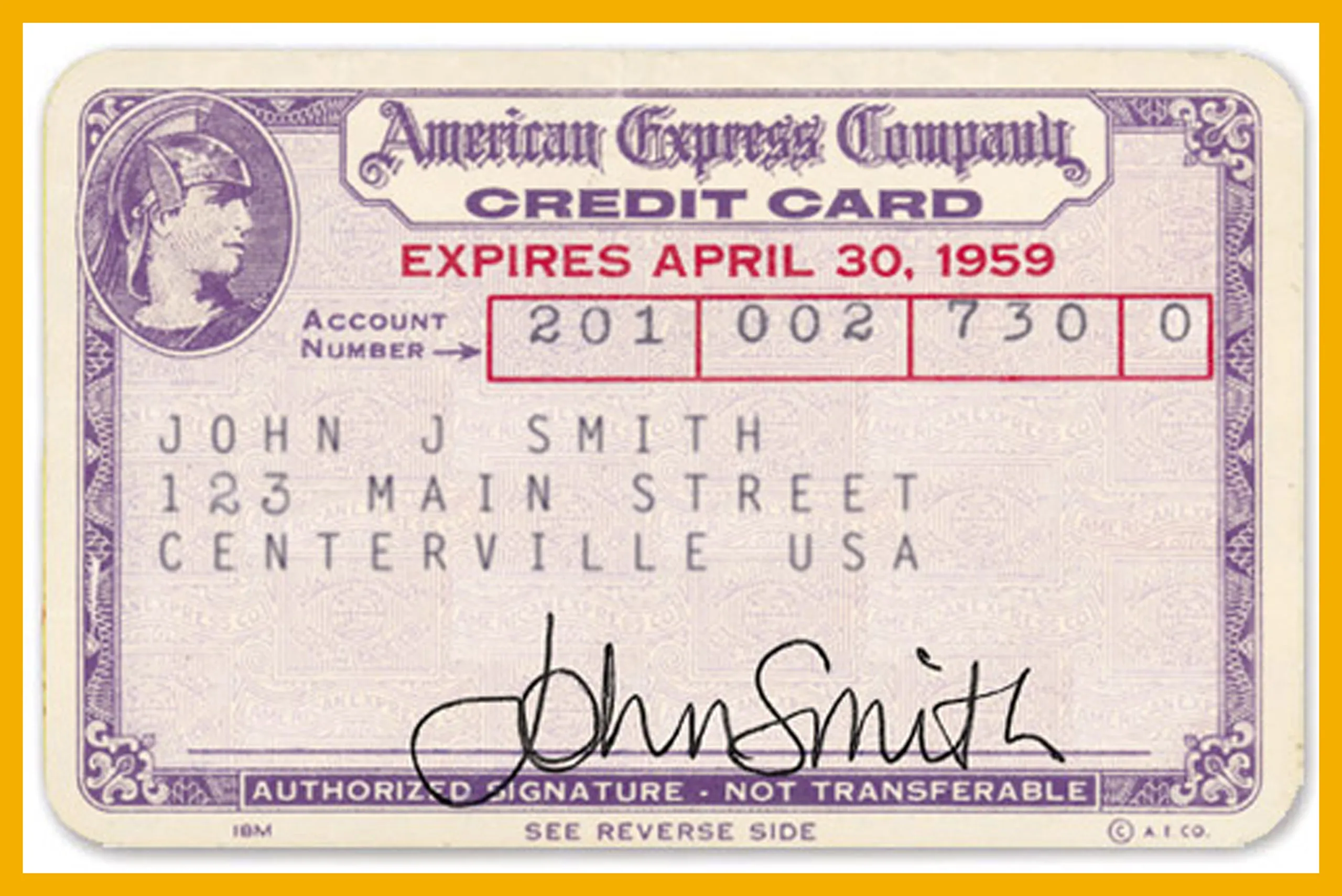

The Detailed History Of Credit Card Machines

Td Credit Card Offer Td Canada Trust

What Is A Contactless Credit Card Forbes Advisor

Avant Credit Card Reviews Is It Worth It 2022

Mastercard Black Card 2022 Review Forbes Advisor

What To Know About Credit What Was The First Credit Card Time

Canada S Best Credit Cards 2022

What To Know About Credit What Was The First Credit Card Time

First Digital Mastercard Reviews Is It Worth It 2022